What they are, how to interpret them and how to use the data to your advantage.

Funding rates are an important part of the crypto derivatives market. Yet many people overlook them as a way of making money, or simply don’t understand exactly what they are. In this article, we’re going to give an overview on all of the basics that you need to know: what they are, how they impact the market and how to take advantage of them.

What are Funding Rates?

Funding rates are the interest rate that is paid on a crypto-to-crypto perpetual swap contract. These contracts allow traders to speculate on the future price of cryptocurrencies.

It is determined by the market and how the futures price fluctuates relative to the underlying spot price. The intention is to keep the derivatives price largely inline with the spot price by offering incentivising or dis-incentivising being long or short, depending on how far the derivatives price has deviated from the spot price.

They are similar to the interest you would pay on a loan. However, as a participant, funding rates can be both positive and negative. This means you either pay or get paid to open a contract depending on if you are entering long or short, which will be determined based on market conditions.

When funding is positive, longs are paying shorts; when negative, shorts are paying longs.

The rates are typically updated every 8 hours.

Funding Rate Analysis

If rates are positive, this means that the derivatives market is more bullish and ahead of the price of the spot market and to bring this inline, there is a cost associated with being long. The bigger the interest rate, the more the derivatives market is pushing ahead of spot.

If rates are negative, this means that the derivatives market is more bearish and behind the price of the spot market and to bring this inline, there is a cost associated with being short. The bigger the interest rate, the more the derivatives market is behind of the spot market.

There are two ways to analyse Funding Rates; by looking at their absolute value and their value relative to price.

When the absolute value of Funding Rate is at historical extremes, this suggests a trend reversal is incoming and that traders are excessively leveraged in one direction and prone to cascading liquidations. The cost of being in this position is also eating into the trader’s equity.

If Funding Rates are decreasing as Price increases, this can be interpreted as being bullish because we know that the derivatives price is generally lagging that of the spot market and margin traders are betting aggressively against organic price action expecting price depreciation.

If rates are increasing as Price decreases, this may be interpreted as being bearish because we know that the derivatives price is generally ahead of the spot market and margin traders are betting aggressively against organic price action expecting price appreciation, whereas the opposite is occurring.

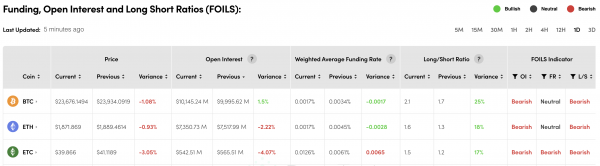

We created a tool which automates this analysis and includes Open Interest and Long/Short ratio in one convenient place – you can access it here! We think it partners rather nicely with the Predator Thermal Scanner.

How do Funding Rates impact traders?

Funding rates can have a significant impact on traders, by increasing the costs of trading. When the rate is positive, it makes it profitable to go short on a contract. This is because you are getting paid to hold the position. Conversely, when the rate is negative, it makes it profitable to long a contract.

The funding rate adjusts to try and balance the number of long and short traders. If there are too many traders long, the funding rate will be very highly positive. This encourages traders to take a short position and collect the large funding fees.

How can you make money from Funding Rates?

It is possible to profit from the fees, whilst maintaining an overall market neutral position. This is done by shorting an asset with a positive funding rate and buying the same asset on the spot market. This is known as Funding Rate Arbitrage.

What is the correlation with Market Sentiment?

There is a strong correlation between the funding rate and market sentiment. When the rate is positive, it generally means that the market is bullish. Conversely, when the funding rate is negative, it indicates that the market is bearish. This makes sense as traders are more likely to take short positions when they expect prices to decline and long positions when they expect prices to rise.

However, if funding rates get too extreme in either direction this could signal a short term trend reversal as traders may have to close their positions as it remains too expensive to keep their positions open.

Conclusion

After reading this article, you should now have a basic understanding of crypto funding rates and how they are used in perpetual swap contracts. We also took a look at some of the benefits and drawbacks of using these contracts. Finally, we looked at the correlation between funding rates and market sentiment.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.