Bitcoin – any need to panic?

Over the past few weeks Bitcoin has pulled back from $30,000 after a failed breakout. Let’s take a look at how significant that is and what may be brewing across both high and lower timeframes.

While there has been some panic in the market over the past few days, when zooming out and looking at the weekly chart we see that Bitcoin is retracing from the mid-point of its range after a strong +100% rally at the start of the year.

Figure 1: BTC Weekly chart with high time frame support and resistance.

At a macro level the lows of June 2021 form the key midpoint level on the chart at $30,000.

Markets take time to heal and it is to be expected that Bitcoin requires some more time to range below that level before heading back up towards new all-time-highs.

The latest Predator candle is amber on the weekly timeframe so it is not suggesting a potential bullish breakout just yet.

Cycles

With the next Bitcoin halving now just 10 months away the narrative around its potential bullish impact on price will likely start to emerge around Q3 this year.

In the 2013 cycle Bitcoin price was bullish heading from this point in time onwards going into the halving.

In the 2017 cycle there were external factors which created major volatility in Bitcoin price action leading up to the halving event that need to be noted when trying to make comparisons.

Figure 2: Bull market comparison with last cycles external factors.

It is impossible to know whether Bitcoin will experience similar external shock events again this cycle, but assuming it doesn’t it is likely that the halving narrative along with government debt issues will put at least some positive pressure on Bitcoin price as the halving draws nearer.

Near term price action

Bitcoin has been in a range between weekly resistance and 4-hour support for the best part of two months now. However, that 4-hour support finally broke earlier this week and Bitcoin price is now testing the 200WMA for a second time.

Figure 3: Key support / resistance and moving averages.

Well below the 200WMA are the 200DMA at $22,700 and the 365MA at $22,330. The 365MA has always served as a bull market / bear market pivot for Bitcoin price. Bulls need that level to hold otherwise it would mark a significant shift in market structure.

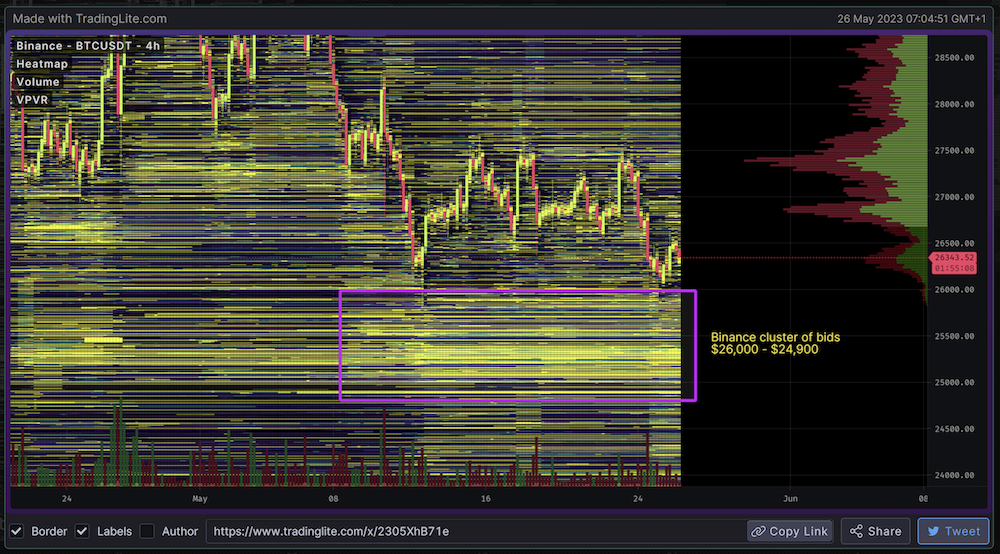

While bears may be hoping for a drop down to the 365DMA moving average and beyond, we note that there are currently a significant number of bids on the order books at Binance which started to get hit on yesterday’s candle wick.

Figure 4: Significant wall of bids on Binance.

Using Moonraker, it identifies that there is also support at the $25,360 level, which sits in the middle of those bids on the Binance orderbook. After that, the next Moonraker support is at $21,300, which is a little below the 365DMA we mentioned earlier.

Figure 5: Moonraker key levels.

If $BTC is able to use the 200 week moving average as support over the next few days and break back into the previous price range, then the resistance price target is up at $28,810.

Conclusion

On higher time frames Bitcoin is clearly now in bull market territory having recovered from last year’s lows, but more time is likely required before we can expect price to approach previous all-time-highs. In the near term there is a potential fake out risk below the 200 week moving average. However, should $BTC be able to break back into the previous range, upside resistance is at $28,810.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.