Bitcoin Dominates

Congratulations for surviving… yet again!

We have just had the wildest day for Bitcoin since the FTX collapse (which was the wildest day since Celsius collapsed… which was wildest since Terra Luna collapsed). Initially it was the bulls who were celebrating with $172.86 million in short liquidations.

This was brought about by fears of collapse of First Republic Bank, who’s stock price had plummeted 70% over Tuesday and Wednesday of this week. This is after dropping 90% in March.

(First Republic Bank stock price)

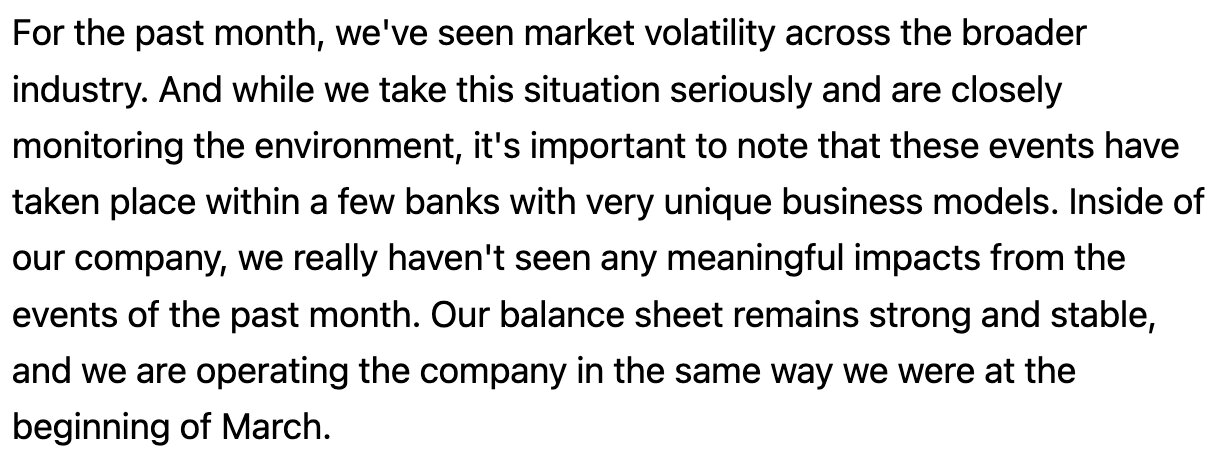

There are multiple examples of claims that the banking crisis is over during Q1 earnings calls. Of course, these remarks were made prior to the continuing collapse of First Republic Bank.

(William Demchak, CEO of PNC during their Q1 earnings call)

The point that is worth highlighting here is that the banking sector is not out of the woods yet, regardless of what is disgusted during an earnings call. So if there is a reasonable chance of further stress in the banking sector, how might we expect Bitcoin to behave? We have now seen multiple times this year the correlation of Bitcoin with Gold during both the SVB collapse and the FRC collapse.

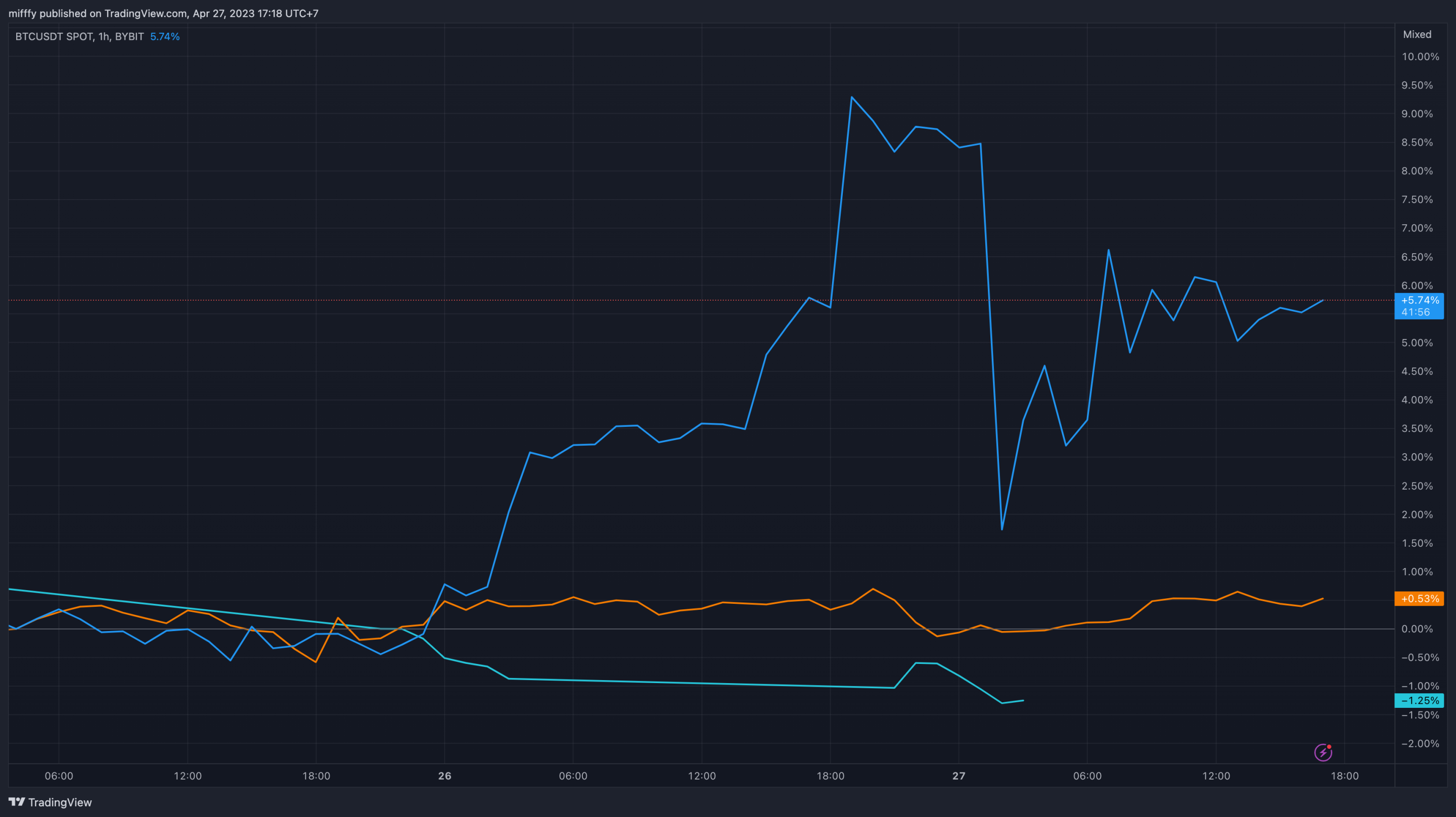

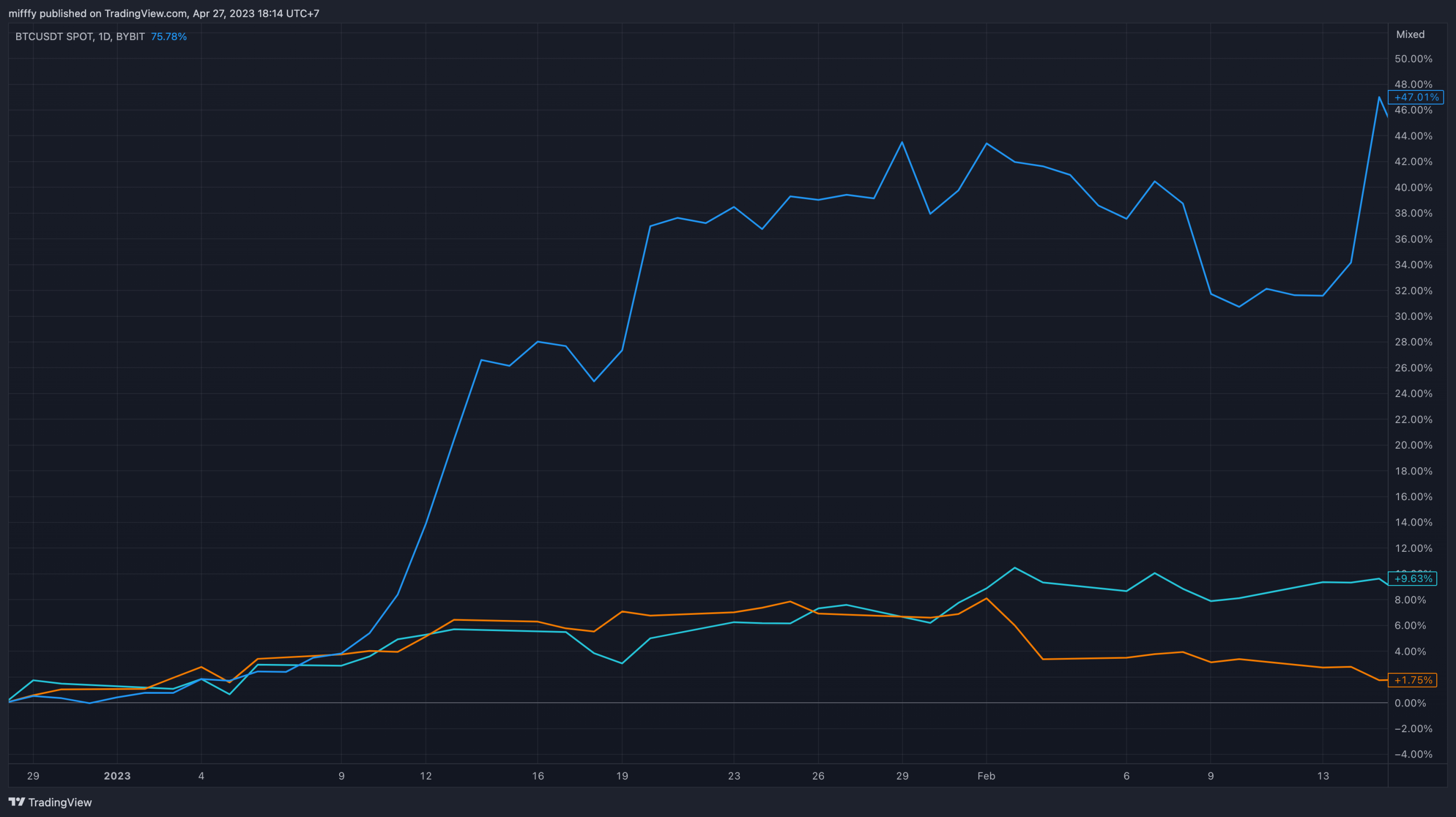

(Bitcoin, Gold and S&P 500 post SVB collapse)

After SVB collapsed, Bitcoin rallied as much as 42.5% as Gold followed with a 9.3% climb. Over the same timeframe the S&P 500 was up only a few percent. Post the FRC collapse, Bitcoin rallied as high as 9.3%, Gold 0.7% and the S&P 500 was down 1.3%. It is worth noting this was all in a single day, representing dramatic moves relative to each asset.

(Bitcoin, Gold and S&P 500 post FRC collapse)

At least for now, Bitcoin seems to be a flight to safety much like Gold typically is for investors. Therefore, theoretically more stress on the banking sector could present more upside for Bitcoin. This would likely be due to either bailouts or the FED pausing rate hikes. The rapid increase in interest rates over the past 12 months has contributed significantly to the recent banking issues, especially as depositors can get much better rates with Money Market Funds, especially when bank deposits over $250,000 are uninsured.

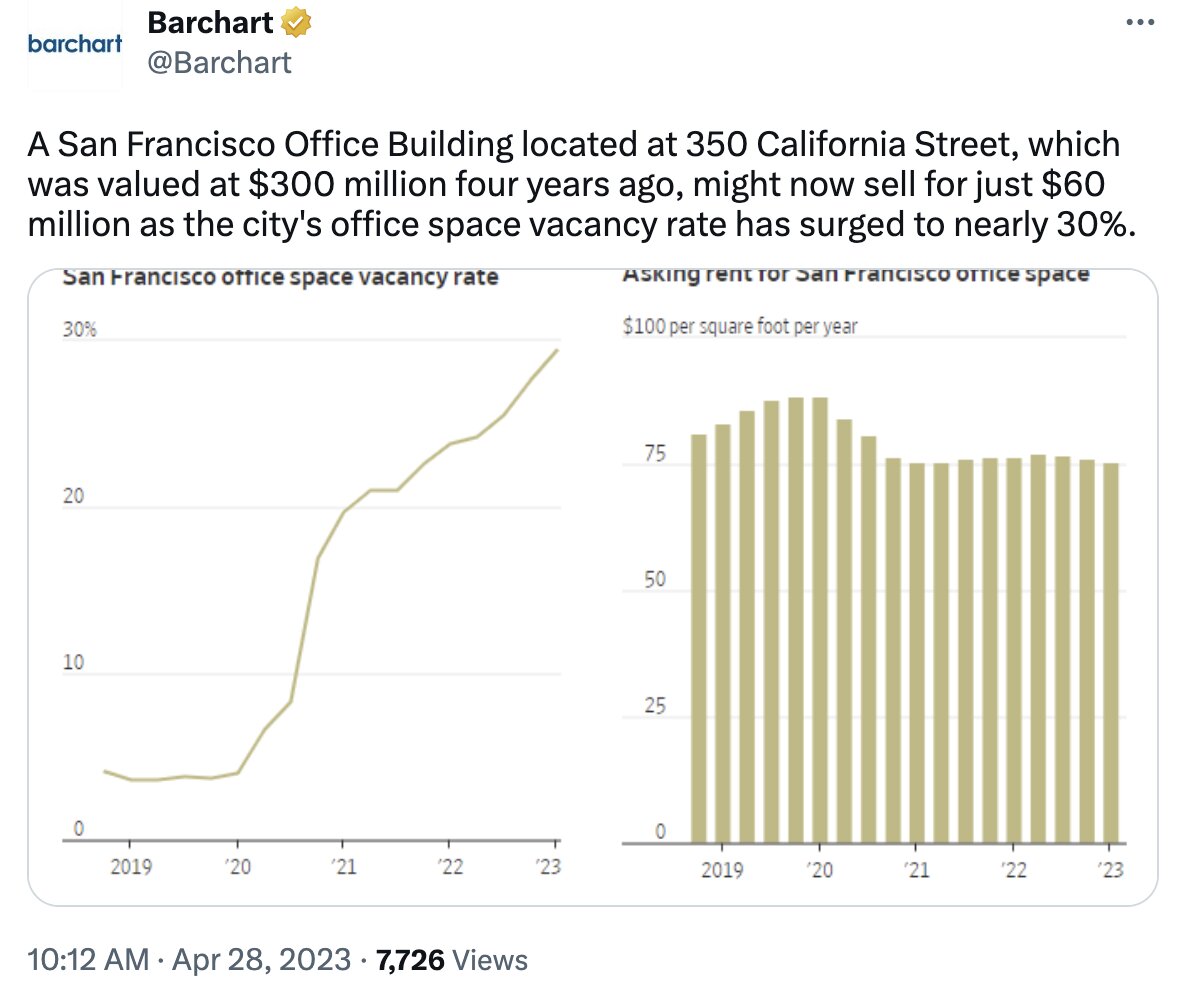

Obviously changes in interest rates affect many aspects of the economy, but a key one is mortgage rates and here lies the next potential crisis. This year $270 billion in Commercial Real Estate (CRE) loans come due and many need to be refinanced. In San Francisco and Los Angeles, the average office vacancy rate is 21.6%. With higher rates and employees choosing work from home over returning to the office, companies who purchase commercial real estate to lease are most at risk of defaulting on their loans.

(BarChart on Twitter)

The above property has been written down 80%, a $240 million reduction. Although it is just one example, Banks represent 54% of the $5.7 trillion CRE market. Of this, small lenders represent 70% of the market, the same small lenders that are already under pressure since the Silicon Valley Bank collapse. The point of reckoning for many of these banks will be at the same time as analysts are forecasting a recession and tighter credit conditions in the US.

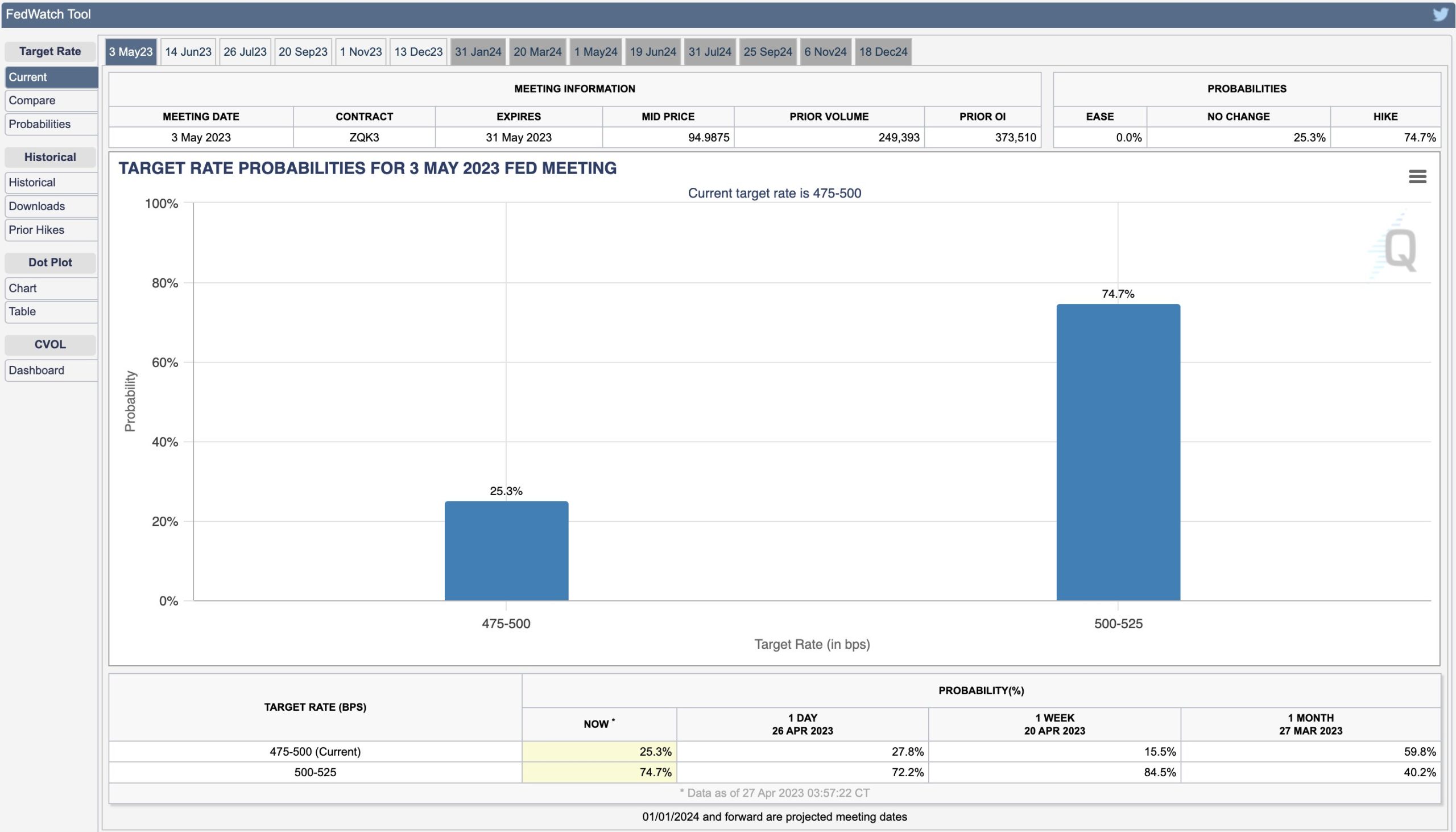

(FEDWatch tool, showing market predictions for the next FOMC meeting)

As a result of this, the market has increased bets that the Federal Reserve will choose not to raise rates at the next FOMC meeting from 15.5% to 25.3% compared to a week ago. A pause in rate rises will likely do well for risk on assets as it will signal the start of any pivot by the FED. Speculation around the FED pausing rates was rife around the New Year. At that point, Bitcoin behaved like a risk on asset and was more correlated to the S&P 500. Bitcoin rallied 47%, the S&P 500 rallied 9.6% and Gold 1.75%.

(Bitcoin, Gold and S&P 500 after New Year 2023)

Now this might seem like it is win-win for Bitcoin as it appreciates in both a risk on and risk off climate. Of course it is too good to be true and Bitcoin has its own headwinds. After touching $30,000 Bitcoin dropped 10%. The specifics are still being determined, but it seems to be that an alert was fired by an on-chain analysis provider, which was labeled Mt. Gox and the US Government, suggesting that Bitcoin from these wallets were being moved. It is important to state this was not the case, just that it seems to have been the incorrect alert that triggered this sell off. The timing and where the fault lies is still disputed.

Regardless, this gives us an idea of how the market might react when Mt. Gox creditors start receiving their Bitcoin. Even though these wallet alerts were Bitcoin specific, Crypto broadly dumped. Since the start of 2023, Bitcoin has continued to increase its dominance even with the Mt. Gox FUD.

(Bitcoin Dominance)

Bitcoin Dominance has been range bound between 40-48% for two years now, but is currently attempting to breakout higher. If this strength continues, it looks like Bitcoin will outperform the rest of the crypto market whilst also suffering the least during any pullbacks – even Bitcoin specific driven FUD events.

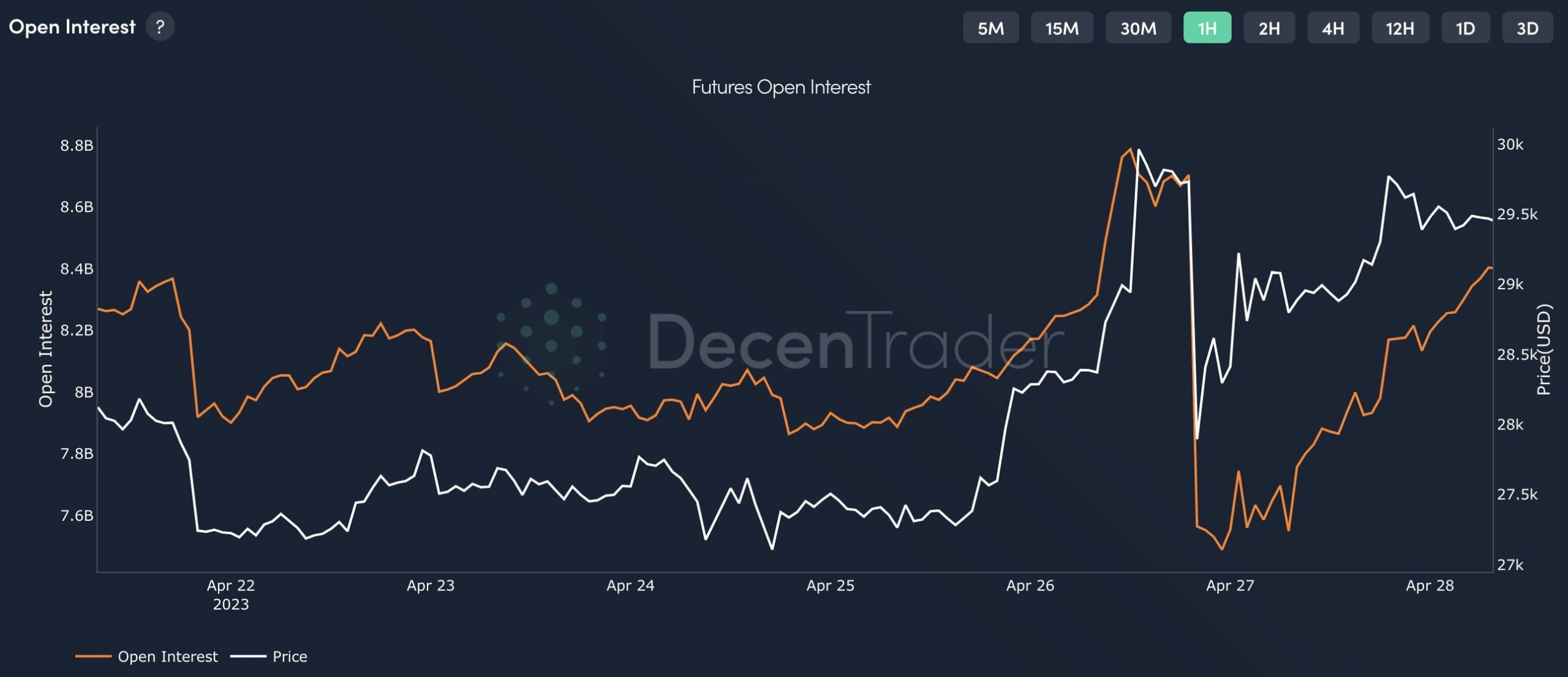

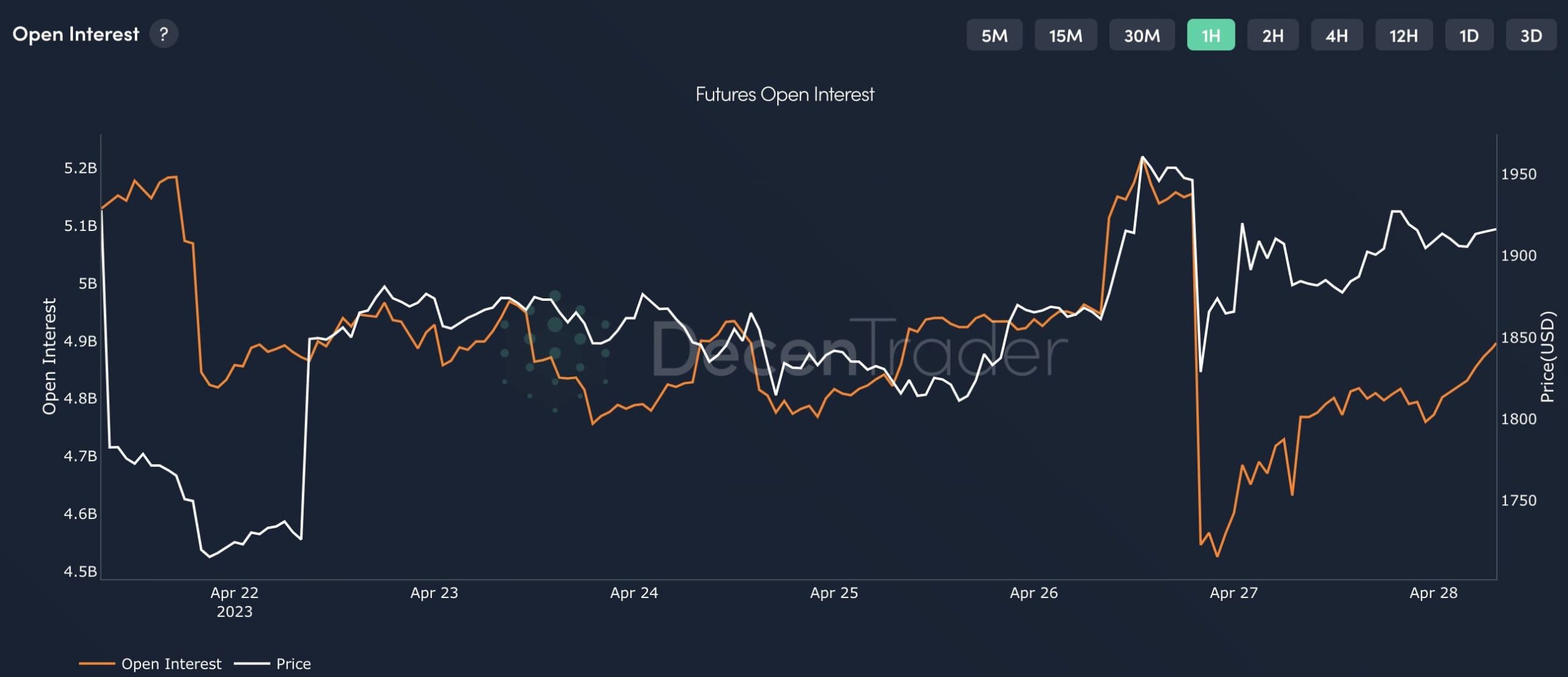

Likewise, we can see that even with a large liquidation event like we have had this week, Open Interest bounces back much more aggressively for Bitcoin compared with Ethereum.

(Bitcoin Open Interest)

(Ethereum Open Interest)

For the true start of any alt-season we would want to see Bitcoin dominance drop and a greater share of open interest among altcoins. We will be watching these keenly moving forwards and if you would like access to the open interest charts, other derivatives metrics and exclusive analysis, sign up for a Decentrader membership using the button below.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.