Bitcoin – Don’t Get Chopped Up!

Bitcoin remains in the range it has been in since the start of the year. While the long-term outlook remains strong, caution is advised in the near term.

Despite that, we have been seeing A LOT of altcoin opportunities on DecenTrader’s Commando Dashboard. On the latest print, Commando is indicating short-term trend opportunities in a specific sector of the market which we will outline below.

The Bitcoin Chop

The market seems undecided as to whether Bitcoin is currently bullish or bearish. Some participants are turning to global macro correlation and screaming bearish, while others are focussing on Bitcoin fundamentals and screaming bullish. The reality for current price action…is chop.

Therefore for trend and momentum traders, risk management is key during such periods.

Figure 1: Key support and resistance levels highlighted by Moonraker.

$BTC continues to chop in this range it has been in since the start of the year, as shown on the chart above.

When we do ultimately break out of the range, should it be to the downside the key levels of support are:

- $32,000: Moonraker support + Log Growth Channel lower boundary.

- $24,400

A move to the upside would meet challenging resistance at:

- $44,000

- $47,500

- $53,000

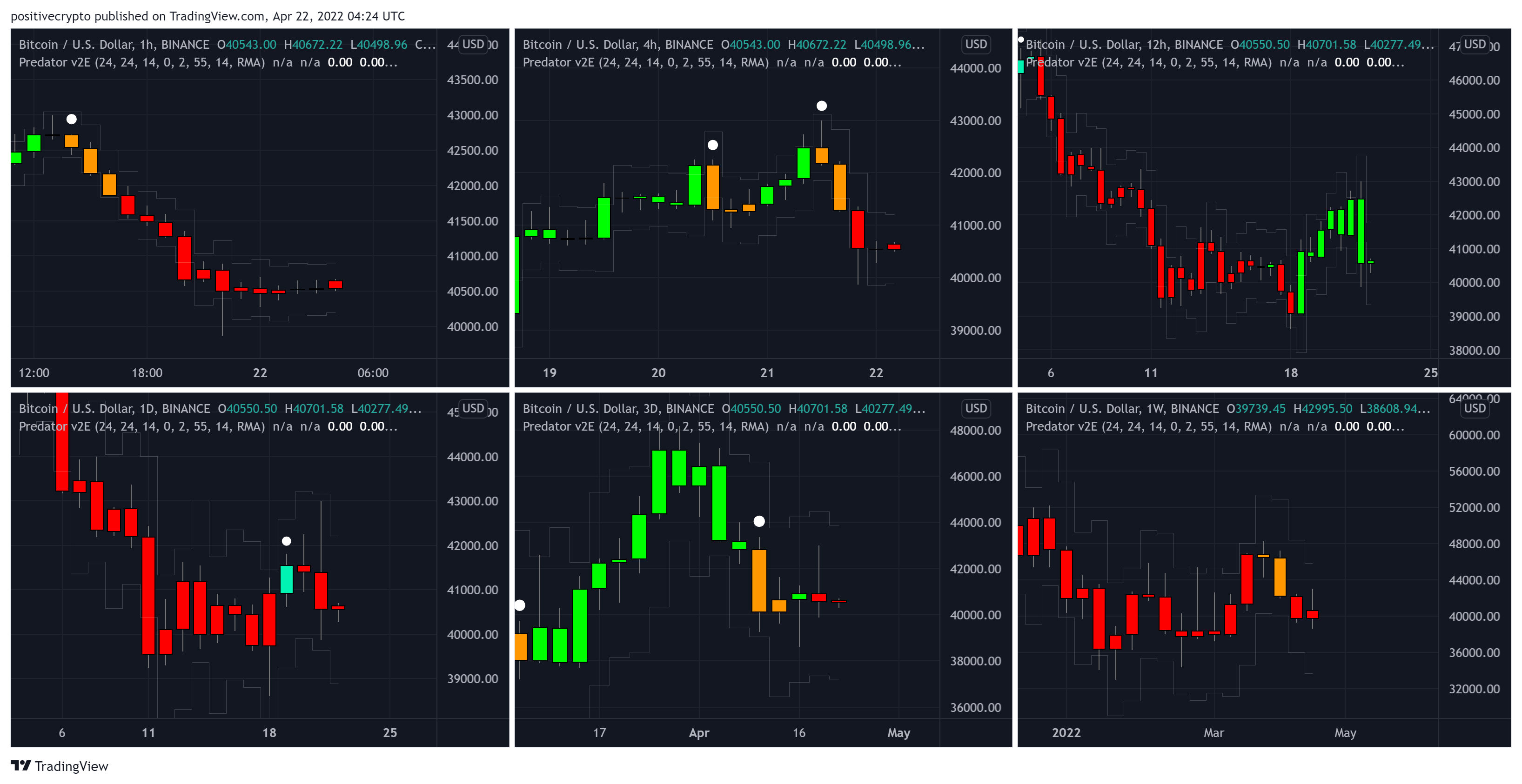

Predator Cross-timeframe

Zooming in across timeframes right now, it should be noted that the majority of timeframes using the Predator tool are bearish at time of writing:

Figure 2: Predator cross timeframes.

Only the 12hr is currently bullish on Predator:

1hr = Bearish

4hr = Bearish

12hr = Bullish

1D = Bearish

3D = Bearish

1W = Bearish

Depending on strategy, for trend-based long traders it may be wise to wait for some more evidence of bullish confirmation in the current market conditions.

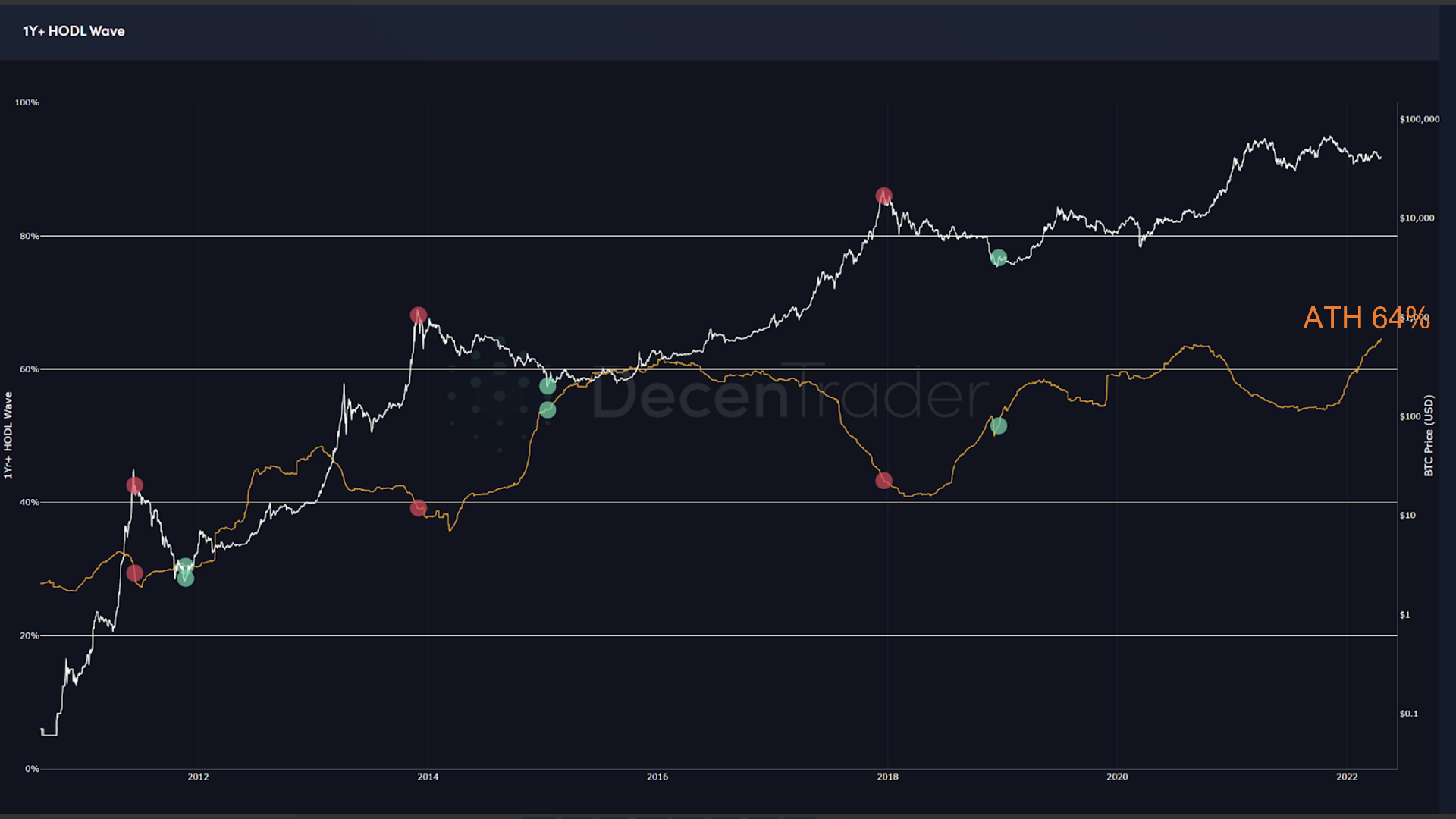

When Do We Get Macro Bullish?

Right now price is below the 1yr moving average (purple line) on the chart below, which has been a bull bear pivot point throughout Bitcoin’s history. This does suggest that we remain in a technical bear market for now until price can convincingly get above that level:

Figure 3: Price has been ranging below the 1yr MA since the start of the year.

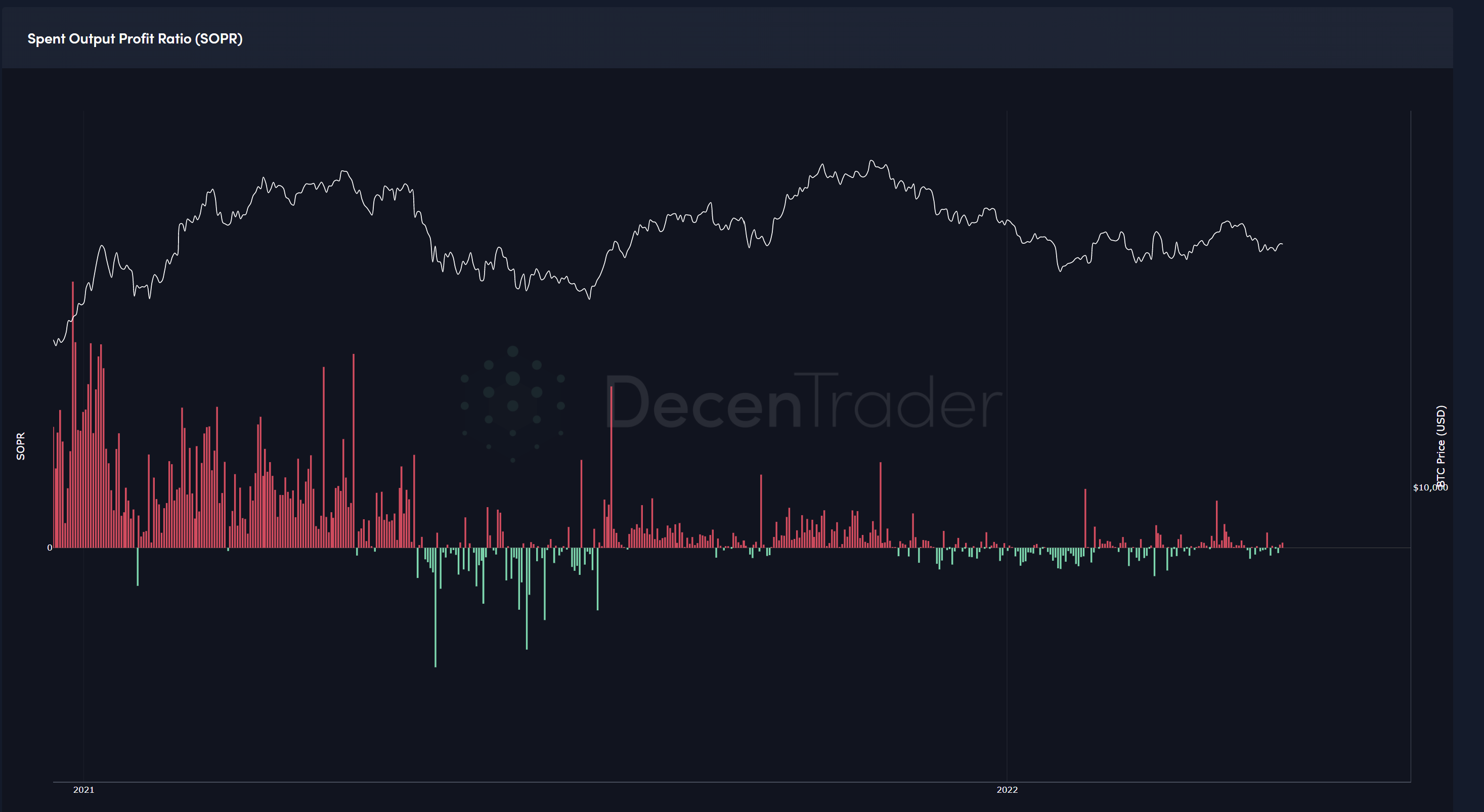

SOPR Shows Why

This bearishness can be seen on-chain when viewing the Spent Output Profit Ratio (SOPR) indicator which shows daily on-chain selling at a loss when it turns green. On macro timeframes, these green levels tend to be good areas to accumulate spot Bitcoin.

Figure 4: SOPR showing recent loss selling on-chain.

It is notable that the levels of loss selling (green bars) are decreasing over time. This suggests that weak hands are largely flushed out of the system through this volatility ove the past 6 months.

So who is left? Long-term HODL’ers who are not prepared to sell until price move much higher up. This restriction in short term available supply, does suggest that whenever these short term trader games are complete, $BTC could accelerate up rapidly when real spot buying steps in.

Figure 5: 1yr HODL showing the percentage of Bitcoin not moving on-chain for +1yr now at 64%

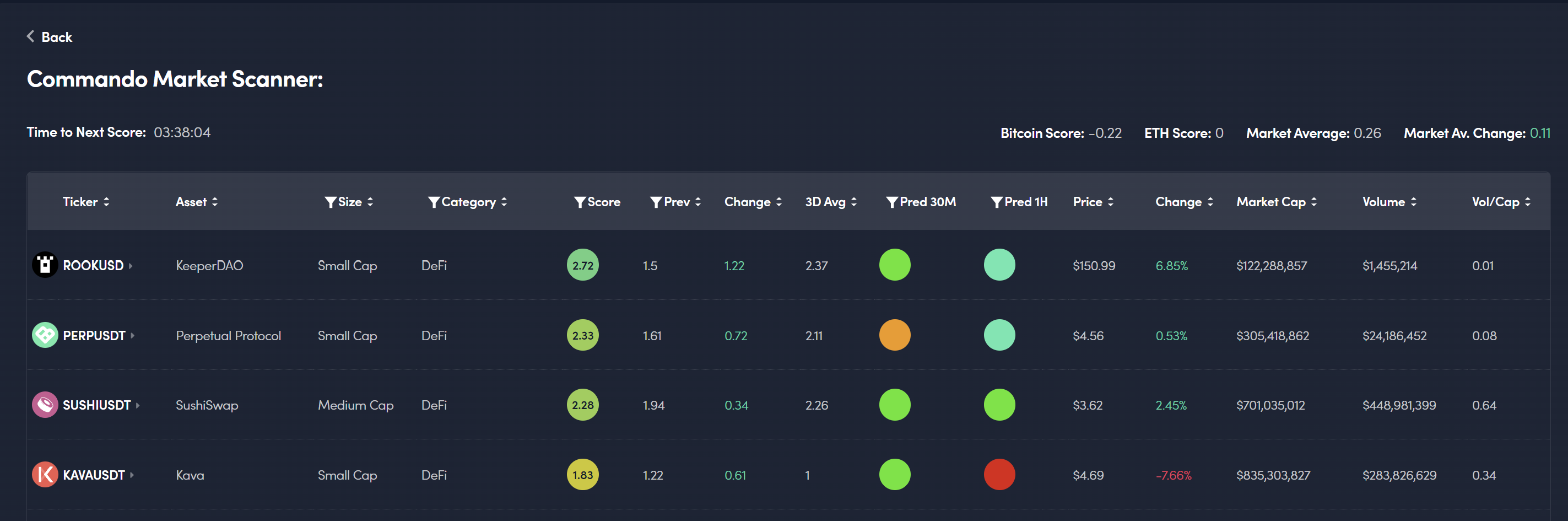

DeFi Opportunities on Commando right now

While Bitcoin has frustrated some traders as it ranges, this relative stability has presented a huge number of opportunities via the Commando Dashboard.

Commando’s algorithms use millions of data points to identify the crypto assets that have statistically robust probabilities of price increases in the following 24hrs. This approach presents fresh opportunities every 4 hours across over 100 crypto assets.

On the latest Commando dashboard print (04:00UTC Fri 22 April 2022), several DeFi tokens look primed to move higher while much of the market remains flat or down.

Figure 6: DeFi coins scoring above 1.75 suggesting potential long trade opportunities to investigate.

Not only are the Commando scores of these tokens strong, but so too are their short term (30m and 1hr) Predator scores, suggesting near term upside trend is likely.

Exploring a level deeper on Commando for ROOKUSD (Keeper) we see that the initial opportunity to go long was triggered 3 days ago by a Commando score above 1.8. Since then price has indeed trended up and is now 27% higher.

Figure 7: A Commando score above +1.8 identified a long opportunity.

Although ROOK has already started trending up, the latest Commando dashboard readings suggest that, along with some other select defi assets, it could be ready for further upside heading into the weekend.

You can access the Commando dashboard here.

Speak soon.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.