Bitcoin Has Bottomed!

After a significant pullback last week of 26%, we believe $BTC has bottomed for now and is on track to gradually move up again in the coming weeks.

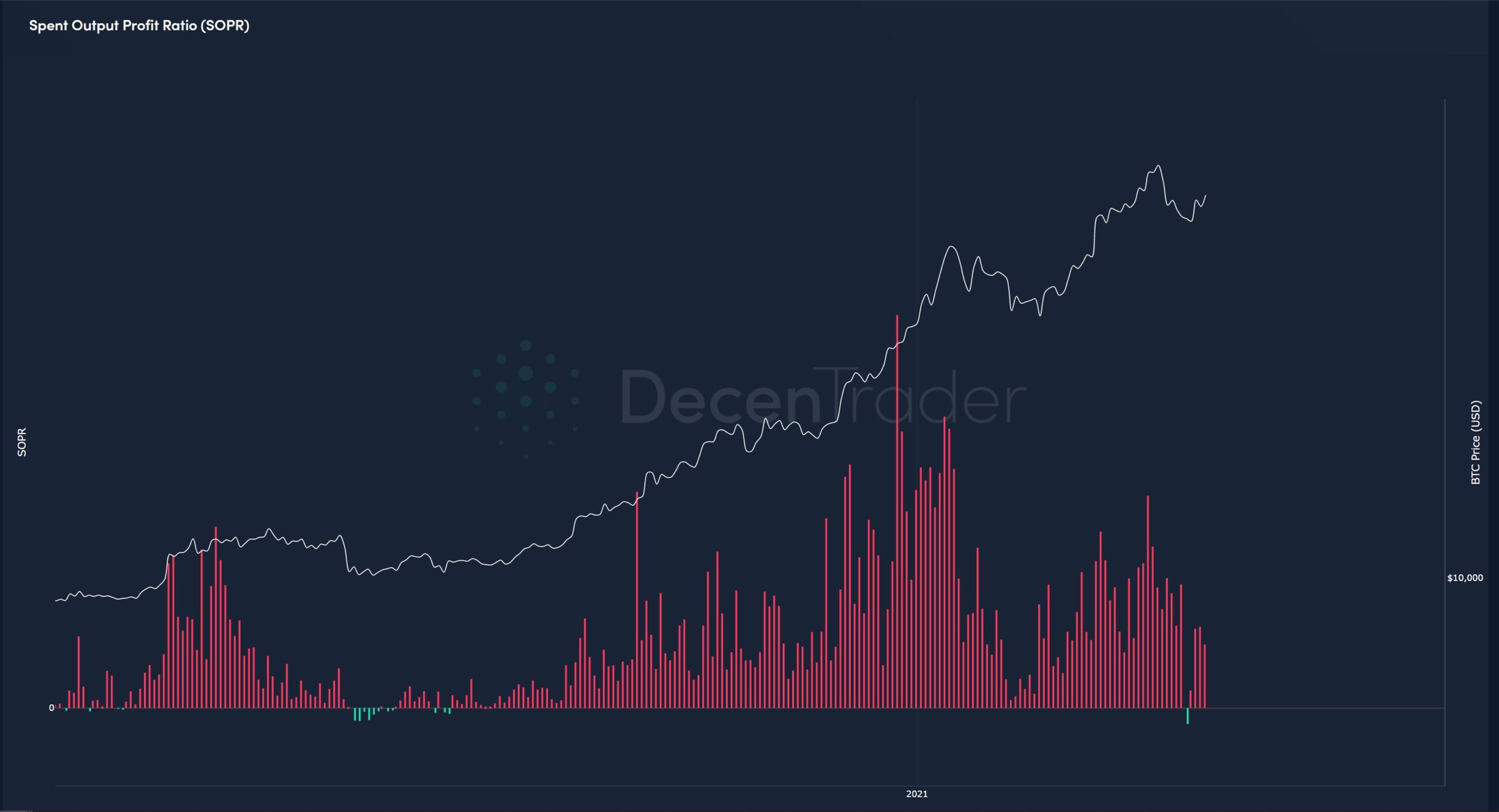

Spent Output Profit Ratio (SOPR)

A few days ago a useful on-chain indicator signalled an opportunity to ‘buy the dip’.

That indicator is Spent Output Profit Ratio (SOPR) which looks at whether on-chain wallets are currently selling their bitcoin at a profit or at a loss.

Typically in a bull market, they sell at a profit (which is indicated by red bars on the chart below). When they sell at a loss (green bars on the chart) this has historically proven to be a very good time to buy in a bull market. The last time we got a ‘green bar’ signal from SOPR was back in September last year when Bitcoin was at $10k. Price then rallied up to $40k before any kind of major pullback.

A few days ago SOPR printed its first green candle since then on the recent price pullback. This is a strong signal that the market may now be ready to continue upwards.

Fig 1: SOPR painting a green bar is a buy the dip signal in a bull market

Funding has reset

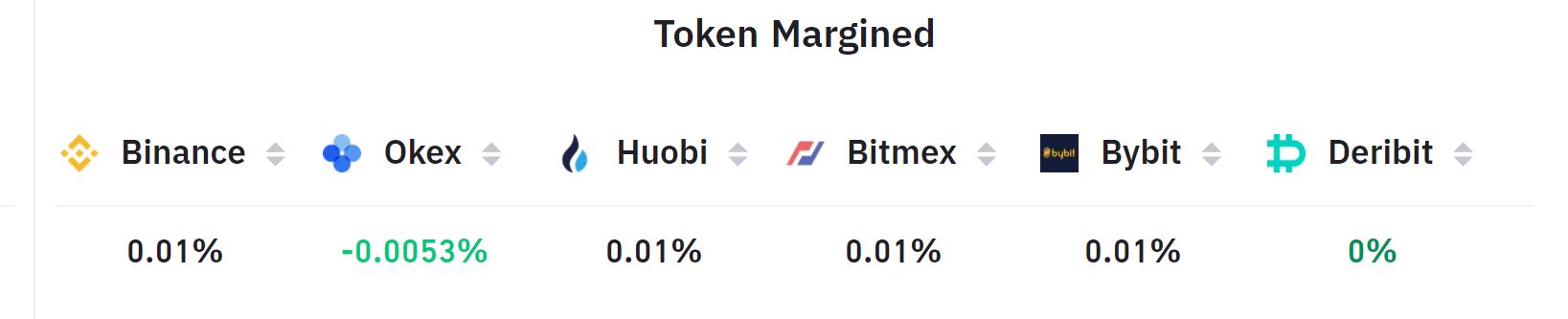

Another important signal is funding rates which have now reset to neutral or negative across the major exchanges.

Fig 2: Bitcoin funding rates across major exchanges

The low scores (we class anything below 0.1% as low) means that derivative traders got scared by the recent price pullback, and have stopped overleveraging with their trades betting that price would go up.

When the price was at $58k just over a week ago, funding was over 0.3% on some exchanges which is extremely high.

So this is very healthy for the market and reduces the likelihood of further major pullbacks, as traders are not using too much leverage at the moment when bidding on the price of $BTC to the upside.

Targets

Finally, from a TA perspective, we can see that the first take profit level we have been sharing in recent updates was hit. Price then came back to retest the 4hr 200MA and has since bounced off it.

Fig 3: First take profit level at $55k was reached

We expect $BTC to range below the previous all time high of $59k perhaps for another week or so before then moving up to $70,000. We continue to be bullish $BTC.

Happy trading and speak again soon.

The Decentrader Team.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.