Bitcoin Ready For Another Major Move Up

All eyes are on Bitcoin right now after Tesla announced on Monday that they had purchased $1.5 billion of Bitcoin for their balance sheet.

While Elon Musk has long been a fan of Bitcoin it is very interesting to see Tesla finally make such an announcement. I expect many other tech CEO’s are currently scrambling to follow in Elon’s and Tesla’s footsteps.

This is yet another tipping point for Bitcoin as both organizations and individuals rush to access Bitcoin.

It makes me very bullish on Bitcoin in the coming weeks, even if we do experience pullbacks on low time frames which is likely.

In this update I will outline:

- reasons to be bullish

- a near-term market top signal to keep an eye on

- price targets

Reasons to be bullish

Liquid’ supply of Bitcoin decreases…as demand increases!

The vast majority of bitcoins are currently being HODL’ed (or are lost) as they have not moved on-chain for a very long time.

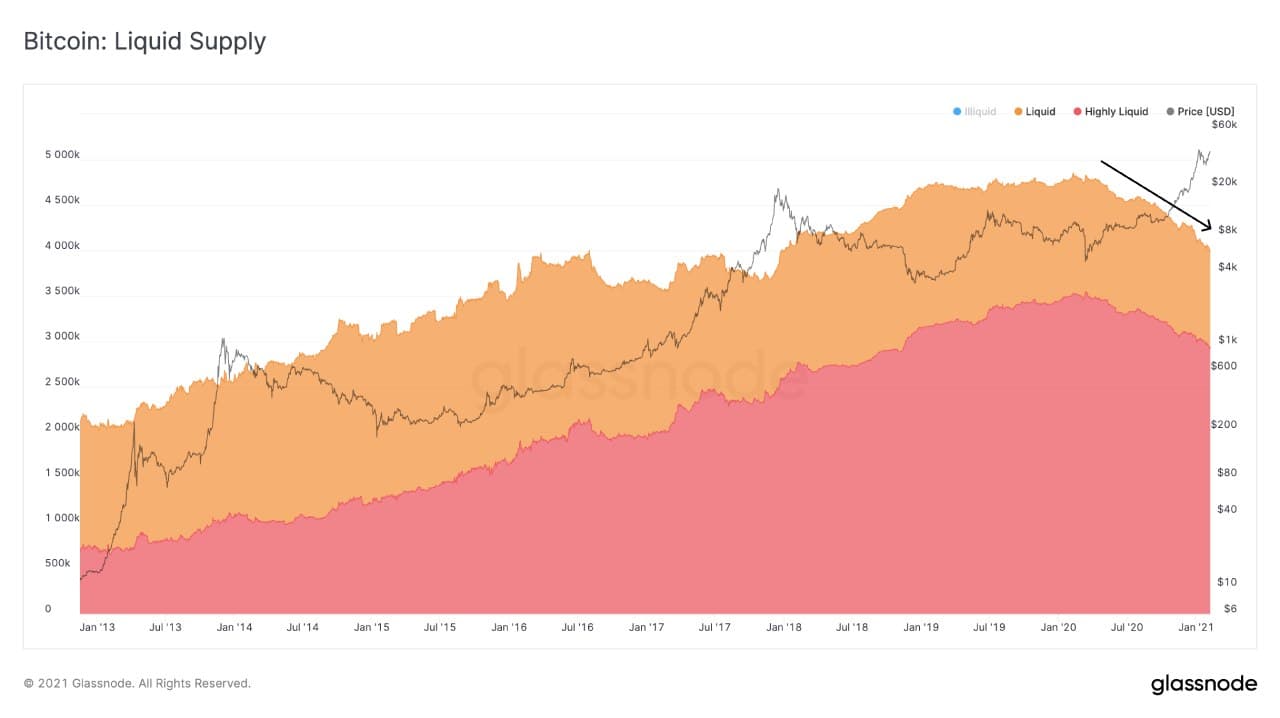

The remainder is what we call ‘liquid’ supply as they move between wallets with some regularity. They are shown by the orange and red levels in the chart below.

Fig 1: Liquid (orange) and Highly Liquid (Red) bitcoin now only account for 22% of all Bitcoin.

This Liquid supply is only about 4 million bitcoin and you can see that the number of them has continued to decrease over the past 6-9 months as more people look to HODL their bitcoin.

Increasing demand from BIG players

As supply is restricted, we are continuing to see big players step into the market to make sure they don’t get left behind. The number of wallets holding over 1000BTC has continued to rapidly increase over the past two months.

This is likely to be made up of Corporations like Tesla, family offices, as well as large institutions.

Fig 2: The number of wallets holding +1000BTC has continued to increase (green line).

What is interesting is that this has happened while the number of smaller wallet sizes have largely stayed flat or decreased. Suggesting that larger players are scooping up bitcoin off smaller players. Ouch!

Below we can see the number of wallets holding over 10BTC have decreased over the past two months as price has rocketed up.

Fig 3: Number of wallets holding over 10BTC

Macro Cycle Indicators suggest we are not near the major cycle top yet

RHODL Ratio is an on-chain indicator which has successfully picked the major tops of each market cycle for Bitcoin.

It uses Realized Value HODL waves which are different age bands of UTXO’s (coins) which are then weighted by the Realized Value of coins within each band. The indicator looks at the RHODL band of 1 week versus the RHODL band of 1-2yrs to show when the market is becoming seriously overheated. It shows that we currently still have some way to go before we enter the red zone which would signal the market is overbought and about to top out.

Fig 4: RHODL ratio: Indicator entering the red zone signals major market cycle top.

Near-term market top signal to keep an eye on

An indicator that is better suited to picking out nearer-term major highs, as well as the final market cycle highs, is MVRV Z-Score.

It looks for extremes in the differences between Market Value and Realized Value at any moment in time. In doing so it is able to show when Bitcoin is majorly overbought or oversold.

Fig 5: MVRV Z-score

When the blue line enters the red zone it is indicating that Bitcoin is very overbought. While it is not there yet, if Bitcoin does significantly appreciate over the coming weeks as I expect it to, then we may see this indicator enter that zone. Historically, that has been a very good time to take some profit.

Near term price targets

Looking at technical analysis and using a fib extension, the price targets that I am personally anticipating should $BTC go on a major run over the coming weeks are:

- Target 1: $54,000

- Target 2: $72,000

- …and a buy the dip opportunity should it arise: $38,000

Overall I continue to be bullish on high timeframes, even if we do get a short-term pullback, and expect Bitcoin to continue its ascent as we head further into 2021.

The Predator Indicator

Finally, we have just created an explainer video of the Predator Indicator tool. It explains how Predator works, how effective it is as a trading tool, and also shows the Decentrader Toolkit that you get FREE when you purchase Predator.

You can watch the video here:

You can access Predator and the free Decentrader Toolkit here: https://bit.ly/2LHUMLl

Speak again soon,

Philip Swift

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.