Market Update – Crypto Showing (early signs of) Strength

After last weekends capitulation down to $17,600, price quickly reverted back up to the $20,000 area where it has continued to hold this week.

We are seeing good buying volume start to emerge and for now some encouraging signs that Bitcoin may at least attempt to trend up towards the 200WMA. This would also be encouraging for higher-beta alts, many of which have been bouncing hard and outperforming Bitcoin this week.

Below, we will be taking a look at Bitcoin and also the latest crypto opportunities on the new and improved Commando Dashboard.

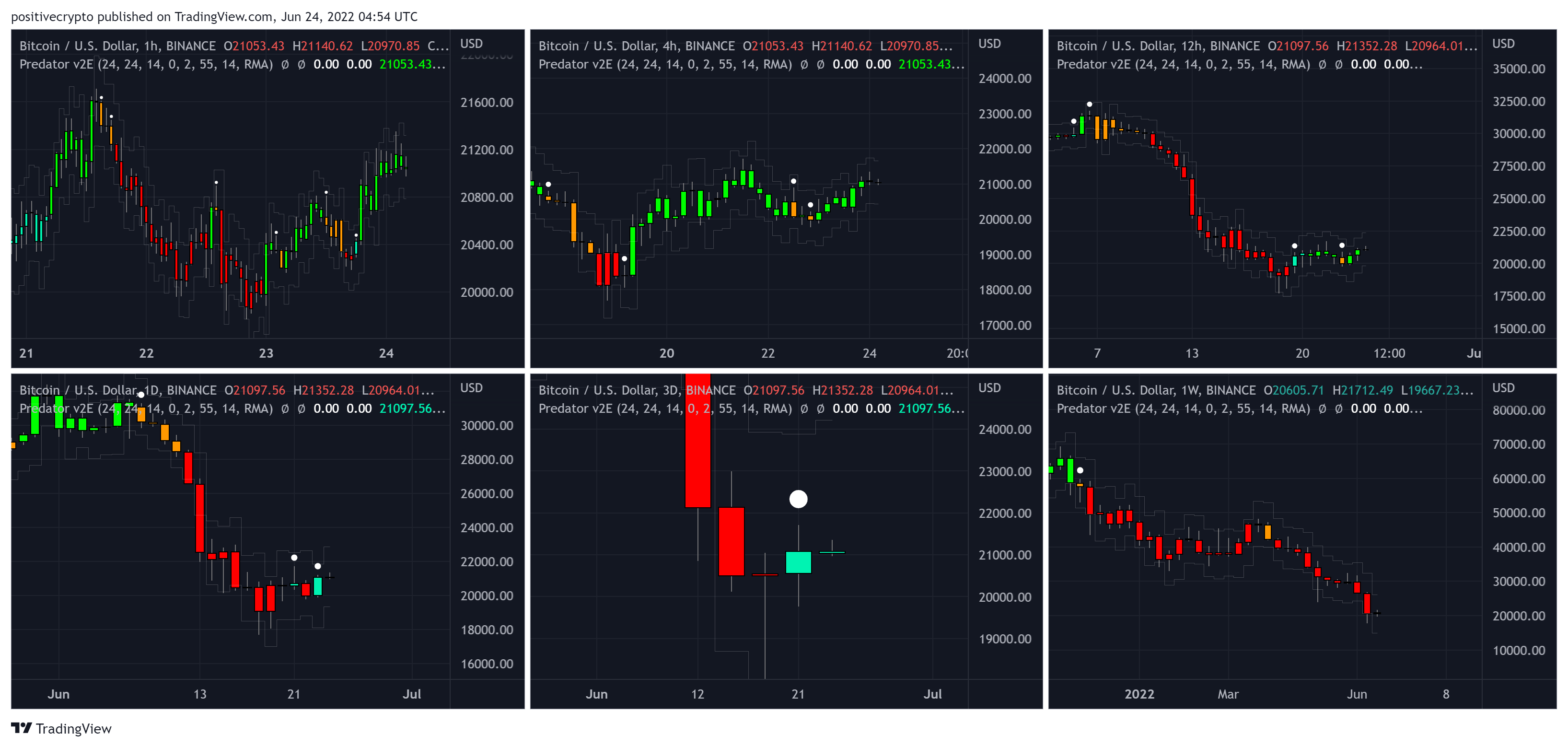

Forming a range after capitulation

Having quickly bounced on decent buying volume after last weekends capitulation, Bitcoin is now forming a range. The mid-point is above $20,000 where volume profile is also based, and BTC has been quickly bought up on any dips below that level this week. The lower boundary is the 4hr close of last weekends’ capitulation at $18,054.

Interestingly the upper boundary which is formed by the pre-capitulation reversal candles, is also lining up with the 200WMA.

The 200WMA has great historical significance having held up price in previous bear markets, and will be of major interest to traders when price revisits it.

Figure 1: Bitcoin now forming a range with the 200WMA lining up with the top of the range.

Over at Bitfinex where we know the whales particularly like to dominate, there is a significant wall of asks at $23,000 just above the 200WMA level.

There is no guarantee that those asks will stay there or cannot be broken when price reaches them. But it is worth noting them and therefore being aware of a potential fakeout risk around the 200WMA that may reject price on its first attempt to break through.

Figure 2: Wall of asks on Bitfinex positioned above the 200WMA.

Predator Turning Increasingly Bullish

At the time of writing several timeframes are turning bullish on Predator:

Figure 3: Predator cross timeframes.

Cross timeframe summary:

- 1hr: Bullish

- 4hr: Bullish

- 12hr: Bullish

- 1D: Bullish (not confirmed until candle close)

- 3D: Bullish (not confirmed until candle close)

- 1W: Bearish

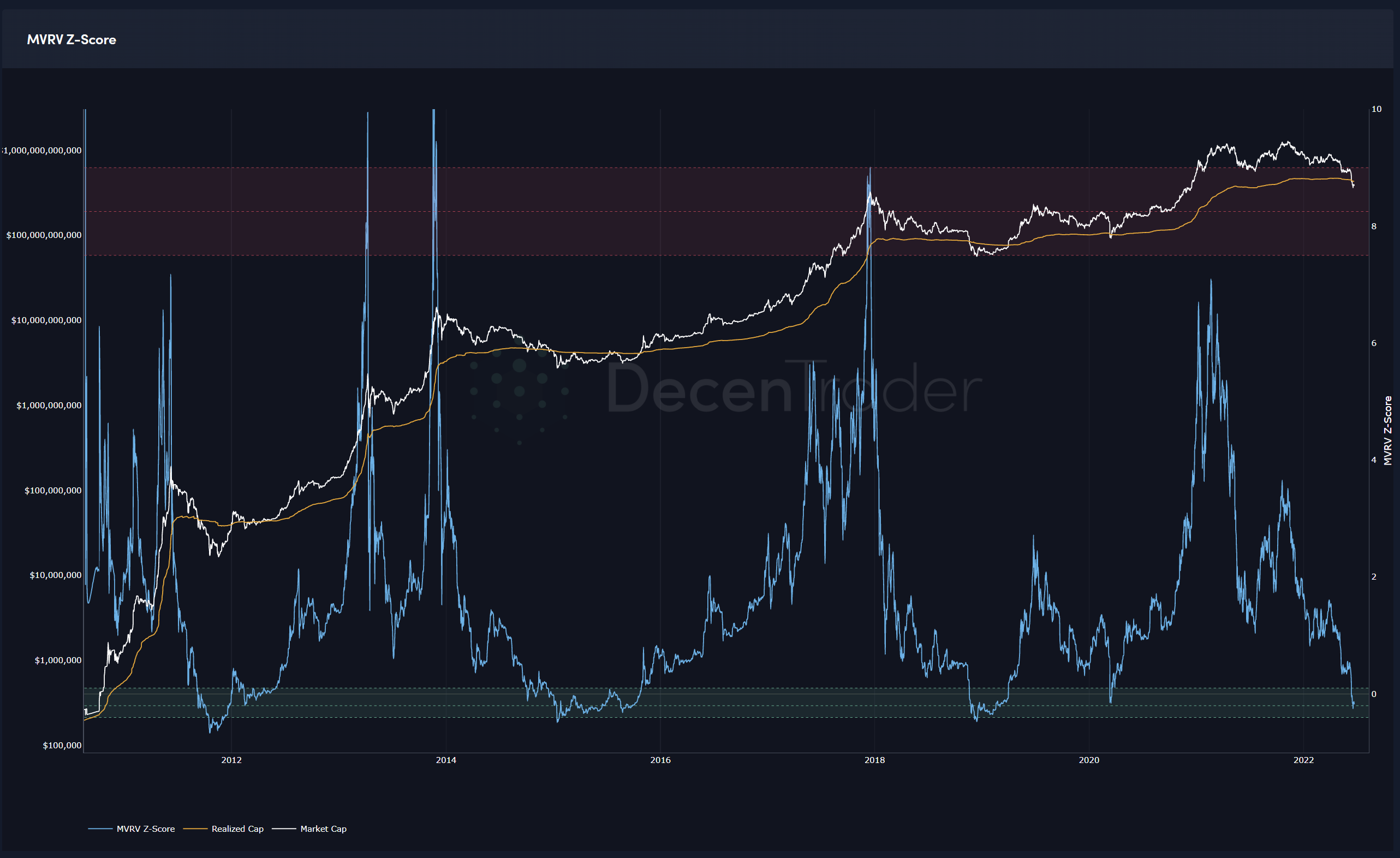

Macro Indicators Signal Oversold

This is within a backdrop of macro indicators signalling Bitcoin is heavily oversold on high time frames. MVRV Z-Score is down in the green ‘accumualation’ zone.

Figure 4: MVRV Z-Score has been in the accumulation zone this past week.

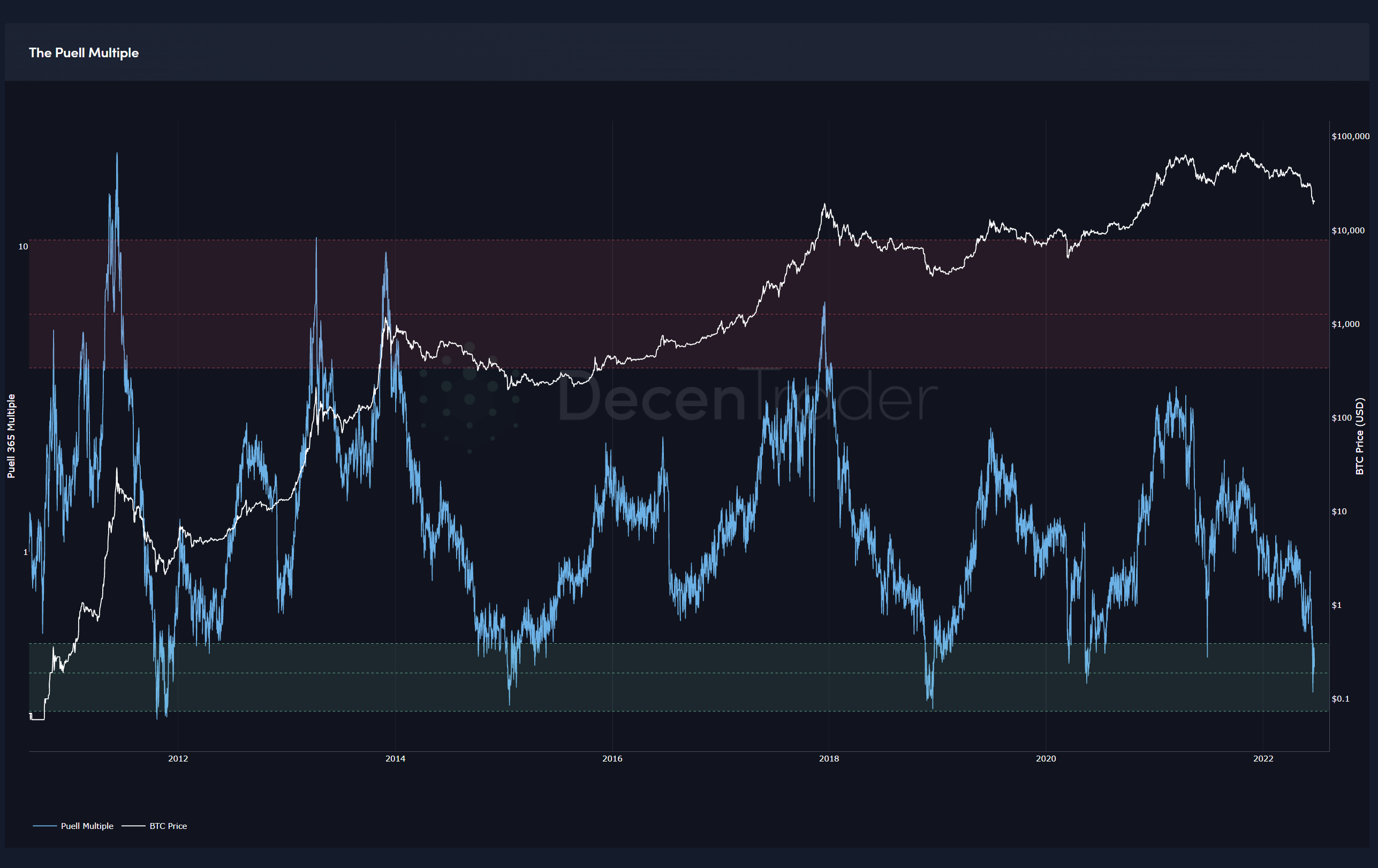

In the aftermath of Celcius and 3AC troubles, there has been increasing talk about miners being severely stress tested, with a high likelihood that many are going out of business and/or have had to offload much of their Bitcoin inventory.

The reason for this is shown by the Puell Multiple which shows current miner revenues relative to historical norms. When it dips into the green zone it shows periods where miner revenues are extremely low on a relative basis.

During such periods certain miners can capitulate. Historically these periods have coincided with major lows in $BTC price.

Figure 5: Puell Multiple also now in its accumulation zone.

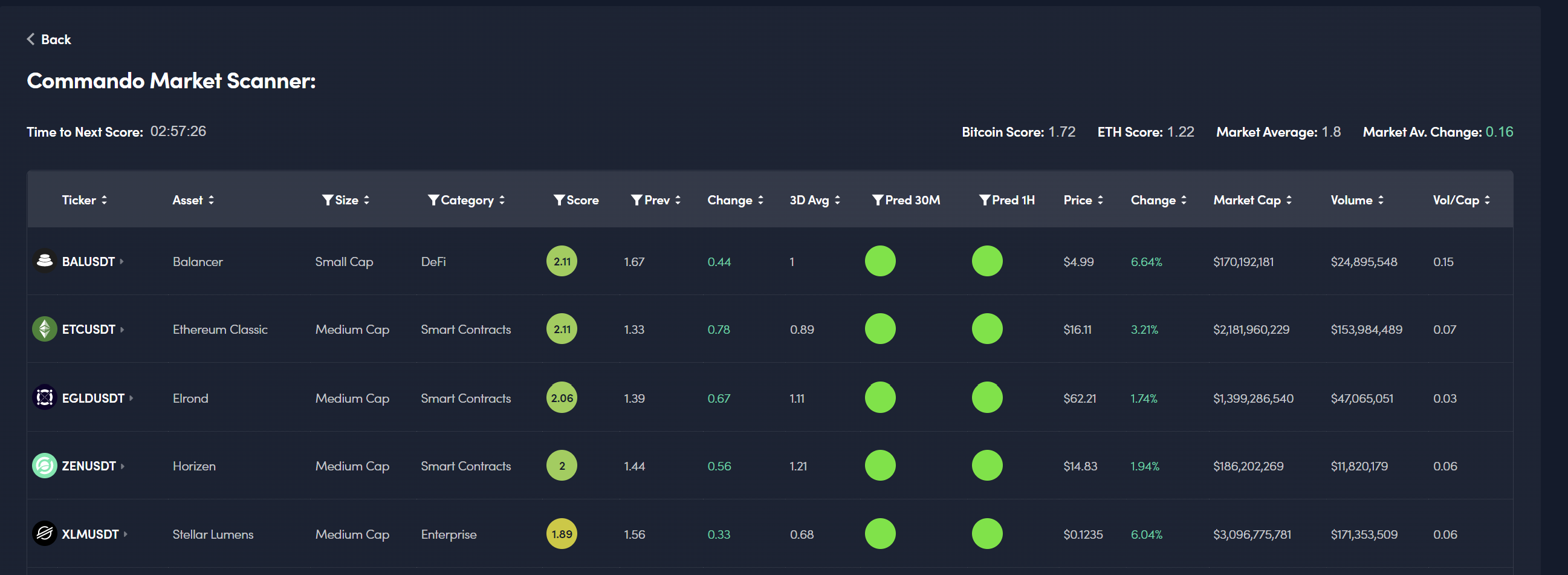

Altcoins bounce back harder than BTC

As the market recovers there have been some huge jumps in price for a wide number of altcoins.

Much of the market is still very fearful with sentiment still at record lows. Times like this are when tools like Commando Dashboard are extremely useful as its algorithms are based on data and are not swayed by emotions.

At the time of writing there are a large number of opportunities that Commando is highlighting. Below is a selection of coins that are seeing Commando scores move up towards 2, which is bullish, and also have strong Predator scores on the 30minute and 1hr which suggests good probability of upward trend continuation in the near term.

Figure 6: A selection of top scores right now from the Commando dashboard.

The new Commando dashboard now also allows the trader to deep dive into each asset, looking at a wide range of derivatives trading data.

Taking the top asset on the Commando list above, BALUSDT, when we deep dive it shows us that funding rates and open interest are currently bullish with a neutral long/short ratio for BALUSDT.

Figure 7: Sample of some Commando dashboard tools for Balancer, BALUSD.

Click here to access the Commando dashboard for Bitcoin, Ethereum and +100 Crypto

Crypto is definitely not out of the woods yet. But we are seeing some early signs which are encouraging for the bulls.

Going into the weekend, we will be monitoring Predator closely on BTCUSD to see if we get bullish confirmation on both the 1D and 3D timeframes. Historically these are very effective at identifying mid-timeframe trend direction. We will also be exploring opportunities on the new Commando Dashboard across a wide number of crypto opportunities beyond Bitcoin.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.