The DecenTrader Alpha

GM. Bitcoin is sitting at $26,000 after last week’s strong rejection of the 200WMA and 200DMA. Predator indicator is bullish on lower timeframes, bearish on 3-day and weekly. And Bitcoin use as margin collateral for futures trading has been increasing.

Past 24hr performance

What Just Happened

- JP Morgan report bullish on spot Bitcoin ETF approval folowing Grayscale win.

- Sam Bankman Fried’s lawyers disagree with DOJ on what SBF should be accused of ahead of Oct 2nd trial.

- Ethereum founder Vitalik Buterin sells his remaining MakerDAO tokens as Maker moves to Solana-based NewChain.

- BTC-margined contracts now account for 33% of the total futures open interest, up from 20% in July.

What’s Happening Now

Bitcoin is up +0.28% in the past 24hrs at a current price of $25,996. It is down -0.39% over the past week.

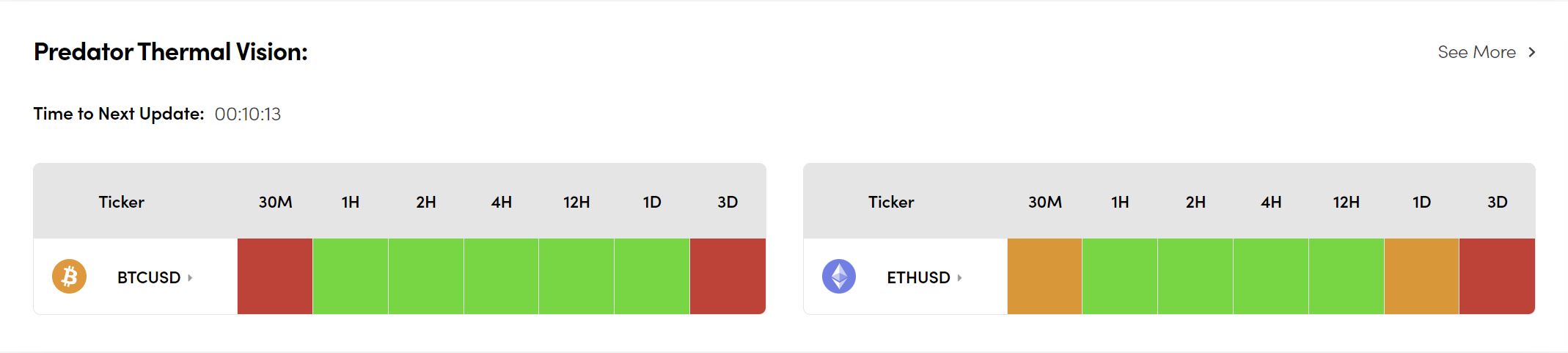

Bitcoin: Predator Thermal Vision is bearish on the 30M and 3D, all other timeframes are bullish.

Ethereum: High timeframe 3D remains bearish, 1H, 2H, 4H, 12H are bullish with the 30M print amber.

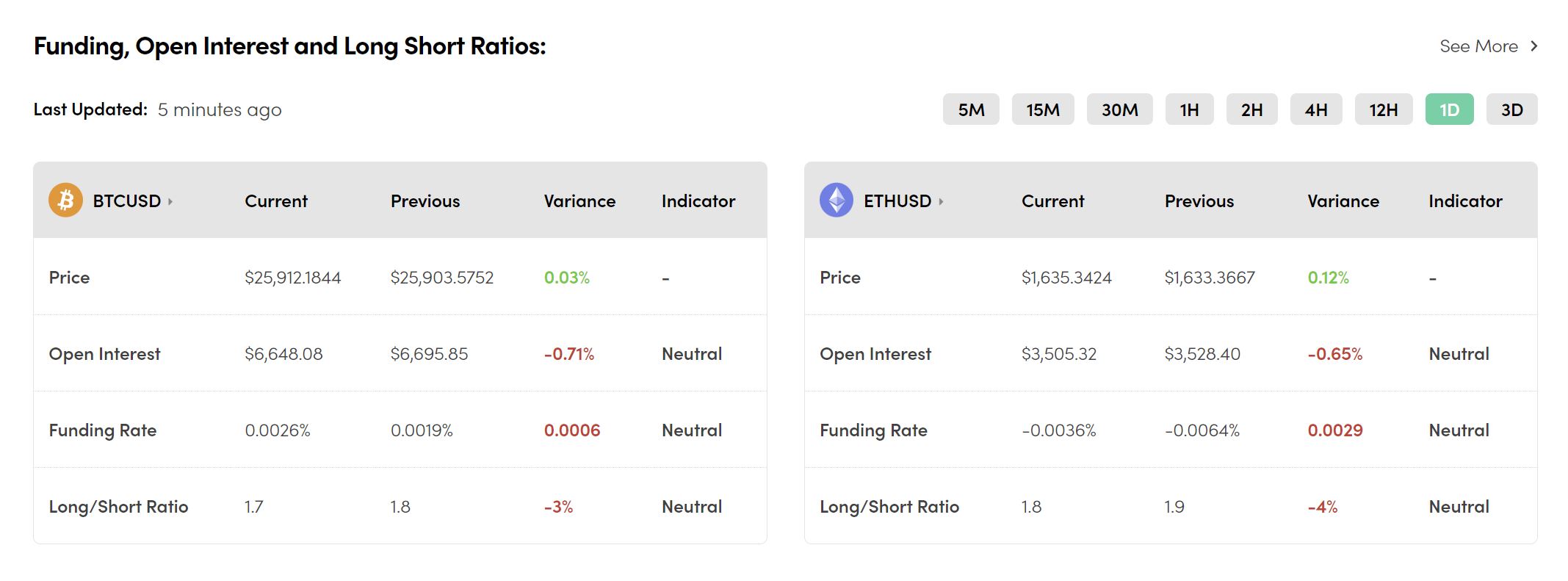

FOILS Bitcoin and Ethereum:

The combined FOILS daily outlook for both Bitcoin and Ethereum is neutral with limited movements in Open Interest, Funding Rates and Long/Short Ratio over the past 24hrs.

Though we note that funding rates are currently low, close to negative.

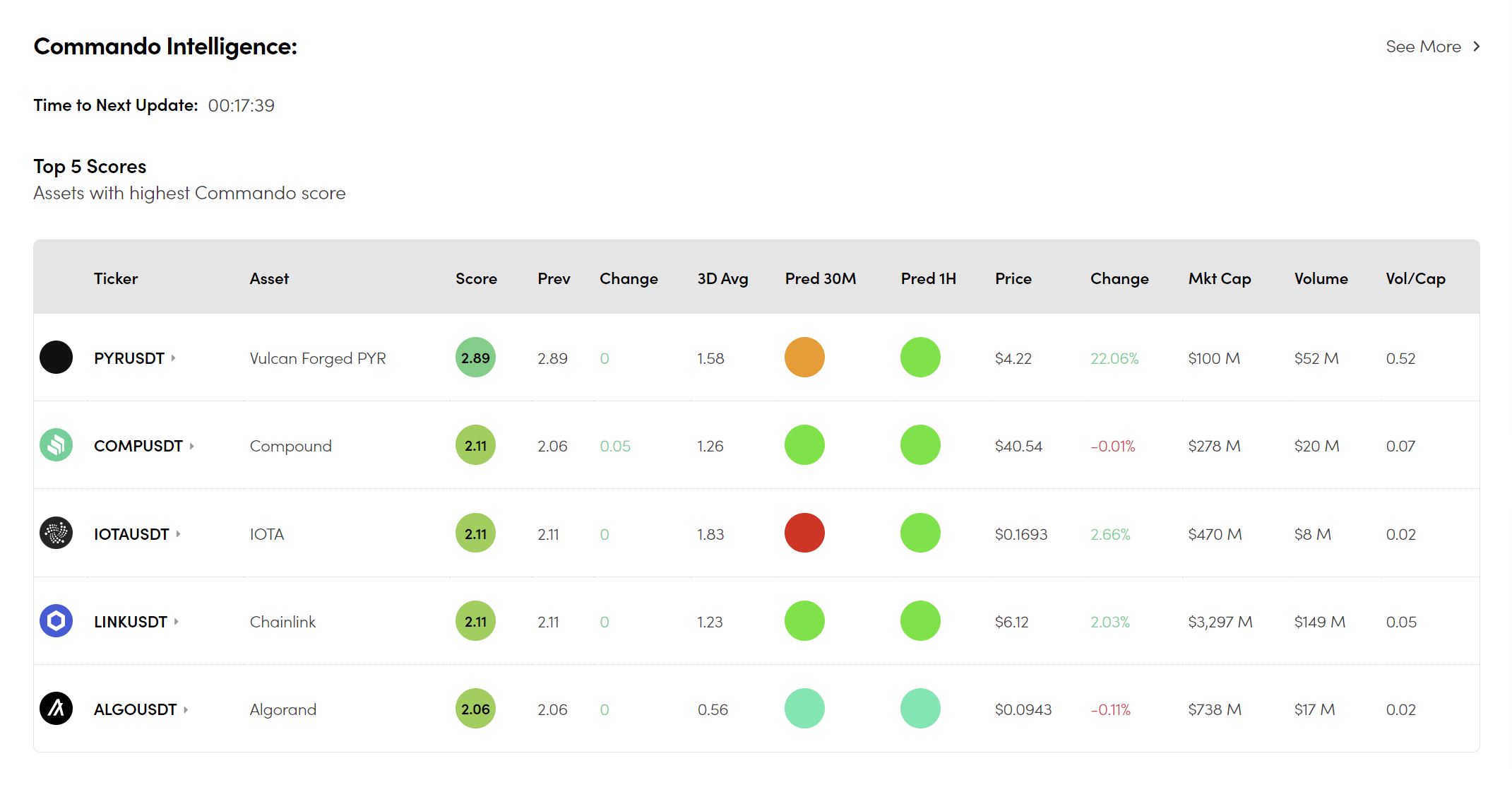

One’s To Watch – Commando Intelligence Top Scorers:

The current top five coins with a Commando score above 1.75 are listed below. Defi projects COMP and LINK have scores of 2.11 and are bullish on Predator low time frames.

What’s Next

Trend outlook:

The weekly Predator chart and Predator Momentum Oscillator remain bearish.

In the calendar this week:

- Monday, September 4th: US Labor Day.

- Wednesday, September 6th: US Federal Reserve’s meeting minutes released.

- Thursday, September 7th: US GDP data released.